Law Firm Accounting and Bookkeeping: Tips and Best Practices JurisPage Legal Marketing

Content

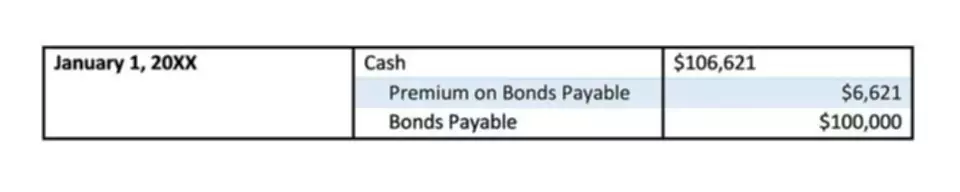

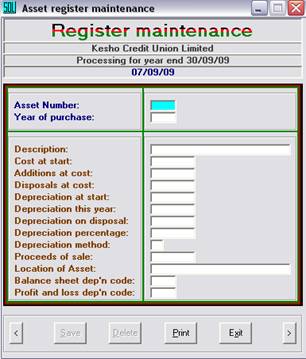

Bookkeepers use accounting software to record transactions, such as invoices, bills, and receipts. Overall, an experienced and qualified accountant can be a valuable asset to any law firm. By taking the time to find the right person for the job, a law firm can ensure that its finances are well-organized and accurate. This can be done by setting up different income and expense accounts for each partner, as well as setting up a trust account to track client funds.

- More errors occur with trust accounting than any other area of accounting for law firms.

- It’s intuitive, reliable, and the industry standard for accepting payments online.

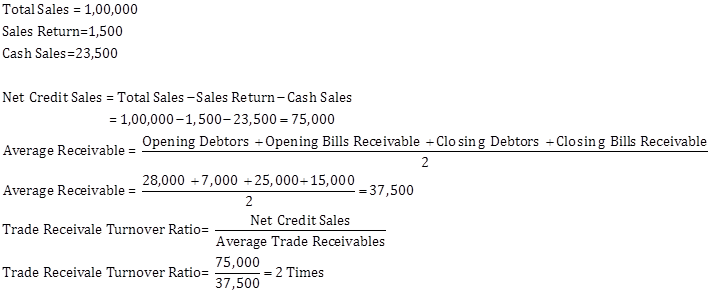

- This can occur when invoices are not sent out in a timely manner, resulting in missed opportunities to collect payments.

- If funds are paid by cheque, record the transaction in your accounting software being sure to apply it to the correct matter.

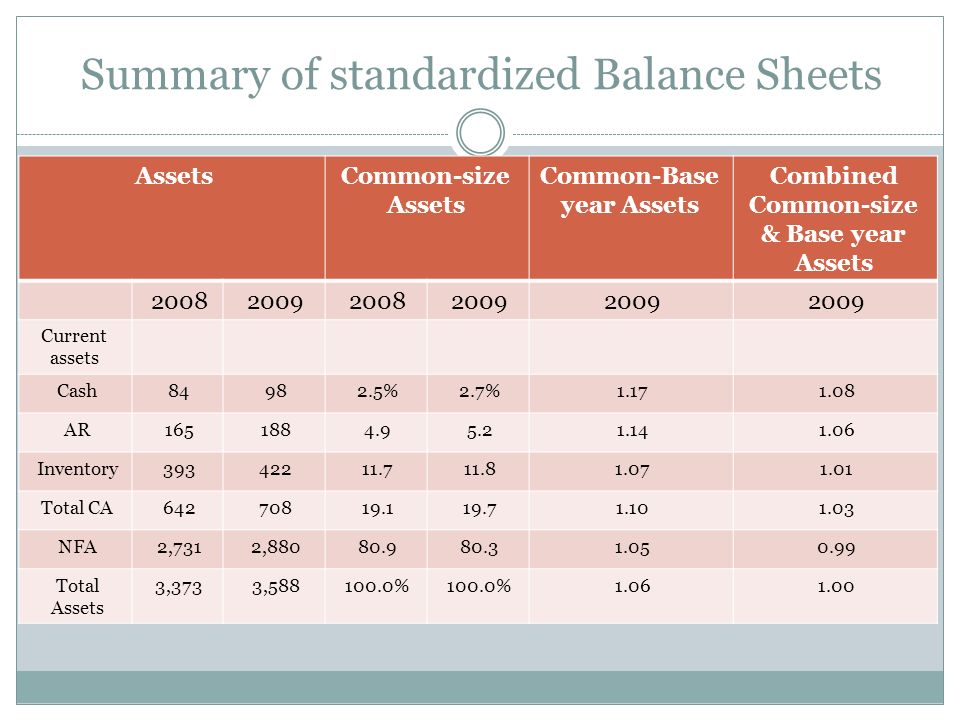

- But they also have all the information you need to understand your firm’s financial health month-to-month.

We recommend choosing one or the other to prevent confusion and for the most accurate overview of your firm’s finances. Bookkeeping requires dedication and attention just like everything else in your firm. We understand what it’s like to have everything fall on your shoulders. That’s also why we recommend eventually hiring a professional bookkeeper to ensure nothing falls through the cracks.

Determine how your firm will get paid

While your bookkeeper will be handling all the daily tasks of adding, subtracting, and balancing, you need to be aware of where your firm’s finances stand and how those finances got to where they are. A standard report can tell you the first piece of information but not the second one. Keeping your firm’s accounts maintained and organized is important; however, it is not as easy as it seems, especially when it comes to handling them on your own. Hence, here we will discuss some of the best ways to improve the financial accounting process of your law firm; read through this piece to get valuable insights on the same. A strong accounting practice will also allow you to plan strategically for the future.

While it is the accountant’s job to handle this the right way regardless of anything else, working with the accountant to make things easier can be very valuable for your business relationship. In case an attorney or a law firm neglects or violates compliance regulations (regardless of intention), it can have repercussions including hefty fines, suspension of license, or disbarment. Accounting and financial management mistakes can threaten the well-being of any law firm.

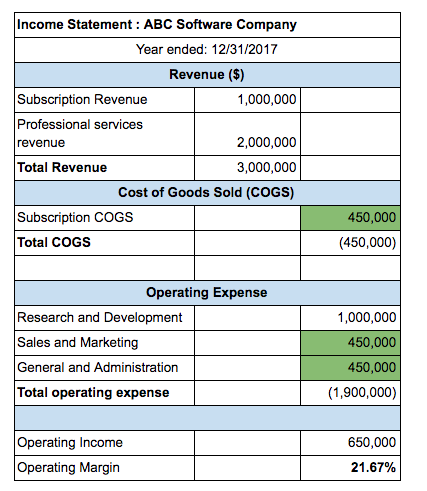

Financial reporting to find opportunities

Instead, revenue is recorded when cash is received, and expenses when they’re paid. Many lawyers do this to solve problems like inadequate cash flow to deal with unexpected expenses. It’s easy to tell yourself that you’ll pay those fees back in time, but don’t do it. Every business requires a business bank account, law firms included. But the right account (and right bank, for that matter) will depend on where you’re located and how you like to bank.

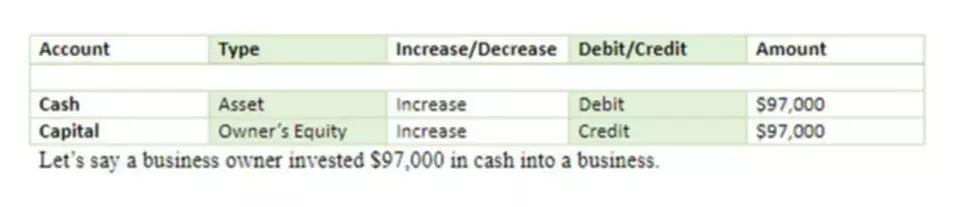

- When using double-entry accounting, all financial transactions will get sorted into specific categories (assets, liabilities, or equity), then once sorted; the two sides should match each other.

- Before you can open a business bank account, your business will need to be registered with the state, have a business name that is registered and have an employer identification number (EIN).

- It is too easy to put the funds in the wrong bank account, mismanage an account, accidentally use funds that need to be saved, or fail to report it correctly.

- Accountants use financial data to analyze, interpret, and create a summary for you.

Get in touch with ProFix today to learn more about how trust accounting works. Anna DiBella, CPA, CGA, will personally set up your trust accounting processes to ensure they meet all compliance requirements. Be sure to follow these processes to avoid any current liability — or work with a CPA specialist in trust accounting — to ensure that your clients have confidence in the security of their trusts. Any client trust funds received by a lawyer must be deposited into a pooled trust account as soon as possible.

Accounting Software

This results in wasted time, mismatched records, billing complications, and even compliance violations. Beyond just staying organized and compliant, following best practices for accounting for law firms will help you identify growth opportunities. So, with double-entry accounting, every financial transaction gets sorted into a specific category (assets, liabilities, or equity).

Clearly presented financial data will help you identify areas in your business that may need tweaking for optimal functionality. This data will also aid in determining the financial feasibility of planned projects or actions, such as taking on a particular client, hiring more staff, or acquiring real estate and other assets. Every state has an IOLTA program, and it’s likely that the bank where you opened your regular business checking account also offers IOLTA accounts.

What Our Clients Say

Software solutions help accurately reflect proper income and even help avoid compliance issues come tax time and regulatory review. You may also use accounting software to manage books using accrual-based monthly accounting and generate cash-based statements law firm bookkeeping for tax purposes. Determine the advantages and disadvantages of both and then consistently use one to ensure accurate tracking of your financial records. The advantages of legal accounting software multiply with today’s cloud-based solutions.

- The most common mistakes are putting funds in the wrong account, accidentally or intentionally withdrawing funds, fail to report monthly, and so on.

- A retainer agreement helps establish terms for your services and payment.

- Good thing you can get outside help from a professional regarding this matter.

- Before any accounting, there needs to be legal bookkeeping performed as an administrative task for all law firms.

- There will come a point when you need to call in professionals for legal accounting, so don’t be afraid to delegate when you need help.

But rules do vary by state, so consult your State Bar Association and a professional accountant before finalizing your accounting setup. Irvine bookkeeping offers you comprehensive, cost-effective, and long-term law firm bookkeeping solutions. With our dedicated and experienced bookkeepers, you potentially transform the financial management of your law firm. When an invoice is paid, you must first allocate the payment to the incurred cost. Nevertheless, many attorneys fail to separate revenue that covers incurred costs from their actual income.

Books and records of law firms

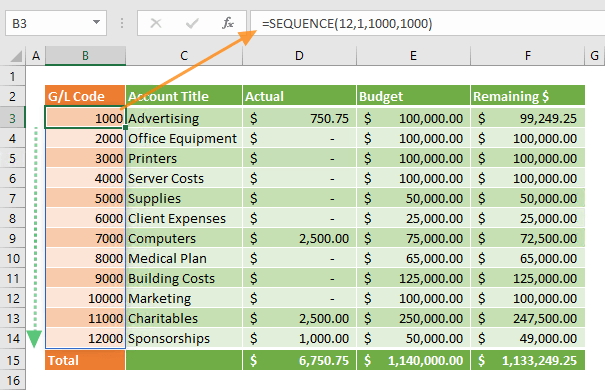

Track billable hours for clients with automated time tracking and billing features, and run custom reports to analyze performance. Import bank statements or electronic credit card statements for automated data entry. Built-in adaptive mapping rules can correct payee names and learn a chart of accounts.

Posted in: Bookkeeping

Leave a Comment (0) →